are electric cars tax deductible uk

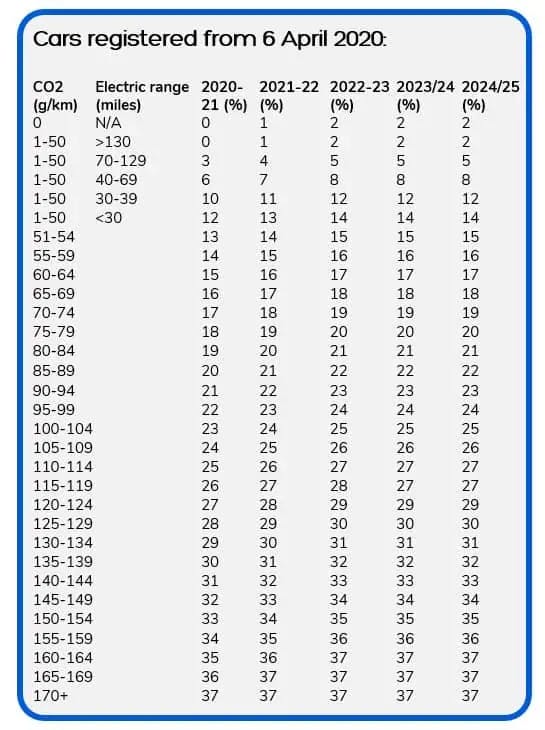

For example a vehicle costing 36000 with CO2 levels of 32 gkm and an electric only range of between 30 and 39 miles will have a benefit rate of 12 in 2021-22 and be. However there have been significant reductions in this charge from April 2020.

A Complete Guide To The Electric Vehicle Tax Credit

Use HMRC-approved software such as Xero.

. If the car is a hybrid. As corporation tax is 19 then your tax savings are calculated as 19. You deduct the cost against profits.

Are electric cars 100 tax deductible UK. Fully electric vehicles can still create substantial savings for both employees and employers when taken via salary. Use HMRC-approved software such as Xero.

This electric car tax relief is potentially a big saving for employees making them more likely to choose an electric vehicle as a company car. The tax rules for ultra low. The company can buy the van either cash or hire purchase and claim all the related costs of the vehicle.

For 2019-20 low emission cars up to 50gkm are taxed at 16 of list price or 20 for diesels. Unlike a combustion engine car businesses can deduct the full cost of buying or leasing an electric vehicle from their pre-tax profits which reduces their tax bills. Buying a car through your.

Are electric cars tax deductible UK. You can also check if your employee is eligible for tax relief. Are electric cars tax-deductible in.

Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances. Because of the tax benefits of electric and hybrid cars this means Tom and the company can potentially save tax and National Insurance of 10103 overall. As with car tax and company car tax the rate at which.

Ad File VAT returns online using HMRC compatible software such as Xero. Need Software for Making Tax Digital. As commercial vehicles new electric vans qualify for the 130.

You pay tax on the value to you of the company car which depends on things. Yes electric car subscriptions are tax deductible in the UK. Tax on company cars.

This means with electric cars you can deduct. Youll pay tax if you or your family use a company car privately including for commuting. You can claim for the capital cost of buying the vehicle as well as for other running costs such as insurance and repairs.

Unlike a combustion engine car businesses can deduct the full cost of buying or leasing an electric vehicle from their pre-tax profits which reduces their tax bills. You lease an electric car for 6000 over the 2022-23 financial year. From 1 April 2020 until 31 March 2025 all zero emission vehicles will be exempt from the Vehicle Excise Duty expensive car supplement.

This charge is deductible for corporation tax purposes. This could then be carried back to the previous year where relief at 19 could be. Presently all cars with a list price.

Electric car capital allowances Capital allowances allow businesses to deduct the cost of an eligible expense from its annual tax bill. Capital allowances on electric cars. For example a fully electric car that cost 50000 would give rise to a benefit in kind of 0 in 202021 with the exact amount changing each year.

Deducting the entire 82000 cost of the car from his corporation profits left a loss of 22000. Find out whether you or your employee need to pay tax or National Insurance for charging an electric car. Ad File VAT returns online using HMRC compatible software such as Xero.

Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances. Need Software for Making Tax Digital.

Encourage Ev Manufacturers To Produce Low Cost Models With Tax Breaks For A Fair Net Zero Transition Broadcast News Items University Of Sussex

Electric Car Use By Country Wikipedia

Overview Electric Vehicles Tax Benefits Purchase Incentives In The European Union 2021 Acea European Automobile Manufacturers Association

A Complete Guide To Ev Ev Charging Incentives In The Uk

Electric Company Car Tax Explained Guides Driveelectric

Thailand Signs Mou With Toyota On Ev Incentives Electrive Com

U K S Government Electric Car Grant Cut Second Time In Less Than A Year Bloomberg

Jump Starting Clean Vehicles With The New Tax Credit

Norway And The A Ha Moment That Made Electric Cars The Answer Electric Hybrid And Low Emission Cars The Guardian

Road Tax Company Tax Benefits On Electric Cars Edf

Labor Launches The Electric Car Discount In Australia Electrive Com

Electric Vehicles Analysis Iea

What To Know About The Electric Vehicle Tax Credits And How To Get More Money Back Wsj

The U S Zigs While The Rest Of The World Zags On Ev Subsidies Bloomberg

Manchin Sets High Bar For Tesla And Gm Electric Car Tax Credits Bloomberg

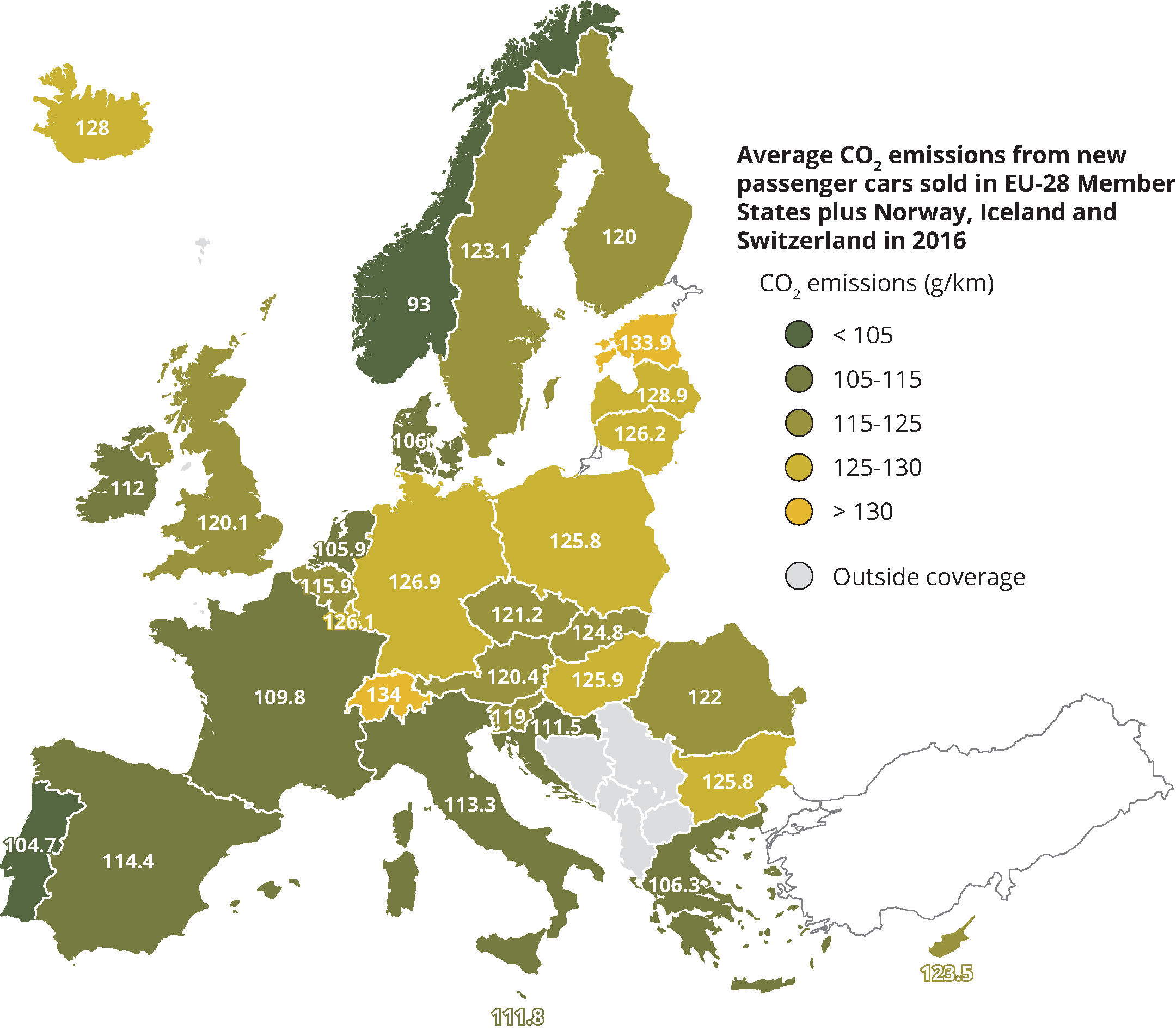

Tax Breaks And Incentives Make Europeans Buy Cleaner Cars European Environment Agency

Yes You Can Still Get Electric Vehicle Tax Credits Here S A Guide Marketwatch

Thinking Of Buying An Electric Car In The Uk Read This First Wired Uk